Bitcoin, the flagship cryptocurrency, has experienced a dynamic journey since it first burst onto the financial scene in 2009. Over the years, Bit-coin has weathered a multitude of market cycles, regulatory hurdles, and technological advancements. Now, in 2024, Bitcoin is reaching unprecedented heights, driven by a confluence of factors that are reshaping the landscape of digital finance. This comprehensive guide explores the drivers behind Bit-coin’s meteoric rise in 2024, forecasts its future trajectory, and provides actionable strategies for those looking to capitalize on this historic moment.

The Genesis of Bit-coin

The Birth of a Revolution

Bit-coin was conceived by the elusive Satoshi Nakamoto, who introduced the world to a decentralized digital currency that operates on a peer-to-peer network. The release of the Bit-coin whitepaper in 2008 laid the groundwork for a financial revolution, and the mining of the Genesis Block in January 2009 marked the dawn of a new era.

Early Adoption and Challenges

In its early days, Bit-coin was primarily adopted by tech enthusiasts and individuals seeking an alternative to traditional financial systems. The journey was fraught with challenges, including regulatory scrutiny, security breaches, and market volatility. However, each obstacle only served to strengthen Bitcoin’s resilience and community.

Mainstream Acceptance

As Bit-coin matured, it began to gain traction among mainstream users and businesses. High-profile endorsements and integrations by companies like Tesla, PayPal, and Square brought Bitcoin into the limelight, paving the way for its broader acceptance as a legitimate form of payment and investment.

Catalysts for Bitcoin’s Ascent in 2024

Technological Breakthroughs

Bitcoin Halving: The Supply Shock

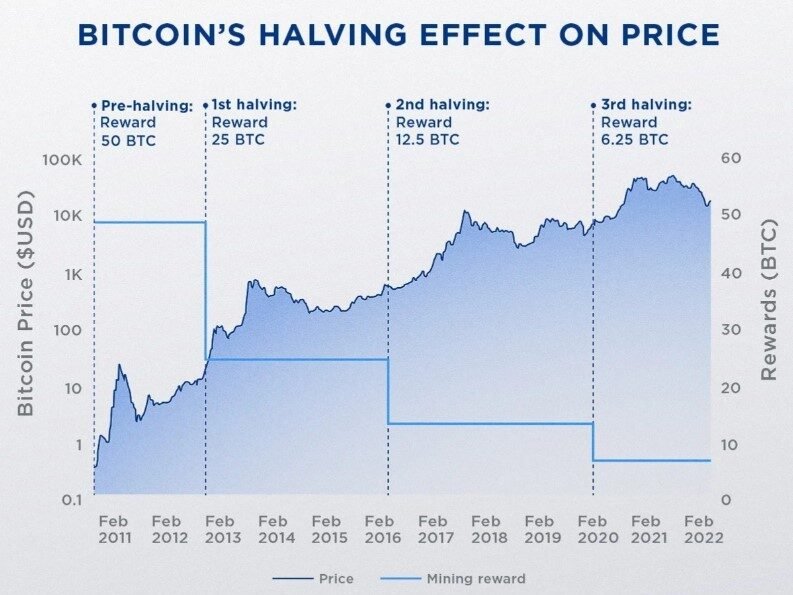

The Bit-coin network undergoes a halving event approximately every four years, reducing the block reward by half. The most recent halving in May 2020 slashed the reward from 12.5 BTC to 6.25 BTC, creating a supply shock that historically precedes significant price rallies. The effects of this halving are being profoundly felt in 2024, as reduced supply meets growing demand.

The Lightning Network: Scaling Bit-coin

The Lightning Network, a second-layer solution designed to enhance Bit-coin’s scalability and transaction speed, has seen widespread adoption in 2024. By enabling off-chain transactions, the Lightning Network reduces congestion on the main blockchain, resulting in faster and cheaper transactions. This technological advancement is making Bitcoin more practical for everyday use and microtransactions.

Regulatory Milestones

Clarified Legal Frameworks

Regulatory clarity has always been a critical factor for the adoption of any financial instrument. In 2024, several major economies have introduced comprehensive regulatory frameworks for cryptocurrencies. These regulations provide legal certainty, protect investors, and foster innovation within the crypto space, contributing to Bit-coin’s rising legitimacy and adoption.

The Advent of Bitcoin ETFs

The approval of Bit-coin Exchange-Traded Funds (ETFs) in multiple jurisdictions has been a game-changer. Bitcoin ETFs offer a regulated and convenient way for retail and institutional investors to gain exposure to Bitcoin without the complexities of directly purchasing and storing the cryptocurrency. This has opened the floodgates for new investments, driving up demand and price.

Institutional Adoption

Corporate Treasury Strategies

In 2024, an increasing number of corporations are adding Bit-coin to their balance sheets as a hedge against inflation and economic uncertainty. Pioneers like MicroStrategy and Tesla have set a precedent, and others are following suit. Corporate treasury allocations to Bit-coin are not only boosting its price but also signaling confidence in its long-term value.

Financial Institutions Embrace Bitcoin

Traditional financial institutions, once skeptical of cryptocurrencies, are now integratingBit-coin into their service offerings. Banks and investment firms are providing Bit-coin custody, trading, and investment products, making it more accessible to a broader audience. This institutional embrace is a significant driver of Bit-coin’s rise in 2024.

Macroeconomic Influences

Inflationary Pressures

As global economies grapple with rising inflation and loose monetary policies, investors are seeking alternatives to traditional fiat currencies. Bit-coin’s fixed supply cap of 21 million coins makes it an attractive hedge against inflation and currency devaluation. This flight to safety is propelling Bit-coin’s upward trajectory.

Geopolitical Dynamics

Geopolitical tensions and economic instability are driving demand for Bit-coin as a safe-haven asset. In 2024, Bit-coin is increasingly viewed as “digital gold,” offering a secure and portable store of value in times of uncertainty. This perception is bolstering its appeal and market value.

Projecting Bitcoin’s Future Trajectory

Price Predictions and Market Sentiment

While precise price predictions are inherently speculative, the factors driving Bit-coin’s rise suggest a bullish outlook. Analysts are optimistic about continued growth, supported by increased adoption, technological advancements, and favorable macroeconomic conditions. Bit-coin’s market sentiment in 2024 is overwhelmingly positive, with many predicting it could reach new all-time highs.

Expanding Use Cases

Bit-coin’s utility is expanding beyond being a store of value. As scaling solutions like the Lightning Network improve, Bit-coin is becoming more viable for everyday transactions, remittances, and as a medium of exchange in emerging markets. This broadened utility is crucial for sustained adoption and growth.

Integration with Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is transforming the financial landscape by offering decentralized alternatives to traditional financial services. Bit-coin’s integration with DeFi platforms can unlock new use cases, such as decentralized lending, borrowing, and yield farming. This synergy between Bitcoin and DeFi has the potential to drive further innovation and adoption.

Strategies to Leverage Bitcoin’s Rise

Investing in Bit-coin

Buy and Hold Strategy

The buy and hold strategy involves purchasing Bit-coin and holding it for the long term, regardless of market fluctuations. This approach has historically yielded significant returns, particularly for those who bought during market dips and held through periods of volatility.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a strategy where you regularly invest a fixed amount in Bit-coin, irrespective of its price. This method reduces the impact of market volatility and lowers the average purchase price over time, making it an effective way to build a Bitcoin position.

Trading Bitcoin

Spot Trading

Spot trading involves buying and selling Bit-coin for immediate delivery. This method is straightforward and suitable for those looking to capitalize on short-term price movements. Spot traders benefit from real-time market prices and immediate ownership of the asset.

Futures Trading

Futures trading allows you to speculate on Bit-coin’s future price using leverage. While this method carries higher risk, it can amplify profits if executed correctly. Futures trading requires a deep understanding of market dynamics and risk management strategies.

Passive Income Opportunities

Staking and Yield Generation

Certain platforms offer staking and yield generation opportunities for Bitcoin holders. By participating in these programs, you can earn additional income on your Bitcoin holdings. These opportunities typically involve locking up your Bitcoin for a specified period in exchange for rewards.

FAQ

What is Bitcoin?

Bitcoin is a decentralized digital currency that operates on a peer-to-peer network without a central authority. It was created by an anonymous entity known as Satoshi Nakamoto in 2009 and is the first and most widely recognized cryptocurrency.

Why is Bitcoin rising in 2024?

Bitcoin’s rise in 2024 is driven by a combination of technological advancements, regulatory developments, institutional adoption, and macroeconomic trends such as inflation and geopolitical uncertainty.

How can I invest in Bitcoin?

You can invest in Bitcoin by purchasing it on a cryptocurrency exchange, participating in Bitcoin ETFs, or through financial services that offer Bitcoin-related products. Ensure you conduct thorough research and consider your risk tolerance before investing.

Is Bitcoin a safe investment?

While Bitcoin has proven to be a profitable investment for many, it is also highly volatile and carries risks. It is essential to do thorough research, diversify your portfolio, and only invest what you can afford to lose.

What is the Lightning Network?

The Lightning Network is a second-layer solution designed to improve Bitcoin’s scalability and transaction speed. It allows for faster and cheaper transactions by enabling off-chain transactions that settle on the main blockchain.

How does Bitcoin compare to traditional investments?

Bitcoin offers unique advantages, such as decentralization, a fixed supply, and potential for high returns. However, it is also more volatile and less regulated than traditional investments like stocks and bonds. Investors should weigh these factors when considering Bitcoin as part of their portfolio.

1 thought on “The Meteoric Rise of Bitcoin in 2024: Ushering in a New Era of Cryptocurrency Innovation!”